I am truly surprised to know that Amazon is spending $200 on its AI strategy, and honestly, I can’t stop analysing whether it is a brilliant idea or too much? AWS is pushing Nova, Trainium, and massive cloud infrastructure, but can all that spending actually translate into real enterprise dominance? As a tech enthusiastic I am seeing a bigger question: are they buying infrastructure or leadership in AI innovation itself? And if startups and developers favor Microsoft, Google, or Anthropic models instead, could this be a gamble that doesn’t pay off? Let’s break it down.

Table of Contents

What AWS is Really Betting On

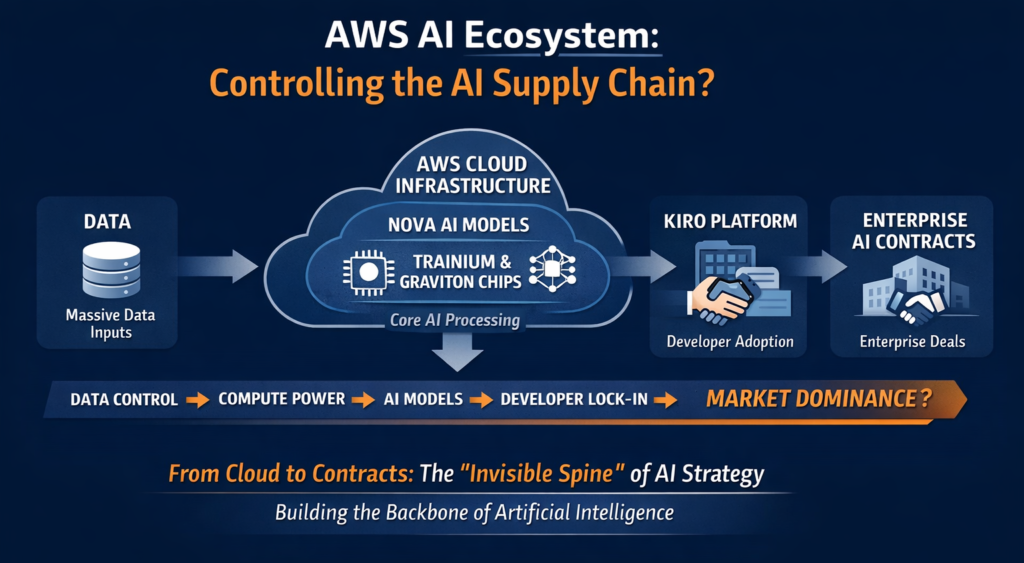

Let’s start with what people are overlooking when they go through headlines about $200B AI Capex: By spending a huge amount on servers’, chips or models AWS is trying to control the entire AI supply chain. Imagine as data flows into AWS cloud infrastructure, which powers Nova AI models running on Trainium and Graviton chips, and then developers adopt these models through platforms like Kiro. As a result, enterprise contracts lock in that usage, creating a cycle where AWS gently becomes the backbone of AI applications without needing to be the “most attention grabbing” AI innovator.

The strong claim to be noticed here is that it is more focused on behavioral economics by influencing developers and enterprises to make adoption choices rather than beating OpenAI or Google at raw model performance. Even if performance slows down against competitors it can create perception of dominance by encouraging users toward Nova and its chips. This is what I call the Nova Paradox: a “good enough” model that locks in customers without needing to be the best.

In the meantime, a massive scale of it is reaching 350,000 employees, thousands of data centers, and global enterprise reach. Now the question arises whether such a massive organization can adjust to these fast improvements while continuing this multi-layered strategy. Here the question isn’t just about Capex or chip performance, but it is about whether it can align culture, technology, and market psychology to make this supply chain stick.

There are two possibilities if it gets success, then without even realizing it will become the invisible spine powering AI for the next decade, shaping adoption. If not, then $200B bet risks being just a gigantic infrastructure pre-purchase in a market moving faster than any corporate bureaucracy.

AWS AI Strategy in Action

Amazon’s AWS is placing a $200B bet on AI, but what does that look like in reality? Let’s break it down using Nova AI models, Trainium/Graviton chips, and enterprise adoption.

In 2025, it generated $130B in revenue, over 60% of Amazon’s profits, yet analysts forecast Microsoft Azure could overtake AWS in AI-powered cloud services within three years.

With focus to double by2027 it added 4GW of data centre capacity in 2025, which approximately enough to power 3.2 million US homes annually. Actually, the real test is can AWS convert infrastructure into stickiness and enterprise contracts before competitors capture mindshare. Because despite skepticism, it is pushing Kiro developer platform adoption, targeting 80% of developers using AI weekly.

It isn’t just building servers and chips; it’s experimenting with behavioral economics, developer psychology, and supply chain control to dominate AI adoption — quietly shaping the AI market for the next decade.

Understanding AWS AI Strategy

If you’re trying to decode AWS’s massive AI play, here’s a simple framework to think about it. First, look at the Capex: $200B isn’t just a number, it’s Amazon’s way of pre-buying dominance in cloud infrastructure. Understanding where this money flows — data centers, Trainium/Graviton chips, Nova AI models — is key to predicting future enterprise adoption.

Second, evaluate the AI model strategy. Nova is marketed as low-cost, but performance lags competitors. This shows AWS may be prioritizing adoption and ecosystem lock-in over outright excellence. When studying AI strategies, ask: are companies pushing “good enough” solutions to control developer behavior and cloud usage?

Third, consider chip and infrastructure leverage. Trainium and Graviton chips give AWS margin control and internal stickiness, but competitors like Google and Microsoft have raw performance advantages with TPUs and Nvidia GPUs. Framework tip: distinguish cost-performance bets from raw performance bets when analyzing cloud strategies.

Fourth, look at enterprise adoption and contracts. It is catching up to Microsoft/OpenAI deals. The framework here: infrastructure dominance alone doesn’t guarantee enterprise AI mindshare. Track who owns the early IP and exclusive contracts, as they shape long-term influence.

Finally, factor in culture and timing. It wants “Founder Mode” agility with 350,000+ employees — a massive scale challenge. Timing also matters: AI markets shift faster than corporate projects can scale. A practical framework: assess culture, adoption speed, and competitive timing alongside tech investments.

✅ Tip for readers: When analyzing AI strategies, think in layers — infrastructure → chips → AI models → developer adoption → enterprise contracts. It is trying to control all layers, and understanding this framework helps spot where the real leverage and risks lie.

AWS AI Strategy: Expert Analysis Backed by Deep Cloud Insights

When I look at AWS, I don’t just see another cloud company — I see the backbone of how AI is reshaping enterprises. With $200B in investments, its own Trainium and Graviton chips, and the Nova AI models, Amazon is playing a game that will affect how businesses use AI for years to come. I’ve dug into the data, the market moves, and what’s happening behind the scenes, and I want to share the insights that most people miss. Trust me, understanding this could change how you see the AI cloud race.

Conclusion

In the end, AWS’s AI journey is as much about vision as it is about scale. $200B in investments, Nova models, and Trainium chips show ambition, but the real question is how the market and developers respond. Will AWS’s infrastructure translate into lasting AI influence, or will competitors outpace it? Whatever happens, one thing is clear: the next decade of AI will be shaped by bold moves like these — and watching them unfold is where the real insight lies.

AWS is reshaping the AI cloud race — don’t miss the insights that matter. Follow TechAscendant for expert analysis, trends, and updates to stay ahead in AI, cloud, and enterprise innovation.

What is AWS’s $200B AI investment?

AWS plans the largest AI capital expenditure in its history — $200B to expand data centers, develop Nova AI models, and deploy Trainium and Graviton chips. This investment aims to accelerate enterprise AI adoption at scale.

How does Nova compare to other AI models?

Nova is AWS’s cost-efficient AI model. It may lag OpenAI, Google Gemini, or Anthropic in raw performance, but AWS emphasizes integration with its cloud ecosystem and chip architecture for broad adoption.

Why are Trainium and Graviton chips critical?

These proprietary chips allow AWS to manage compute costs and performance for AI workloads, reducing dependence on Nvidia GPUs and offering tighter integration with AWS cloud services.

Can it maintain agility with 350,000+ employees?

CEO Andy Jassy emphasizes “Founder Mode” to keep innovation fast and lean, but balancing startup-like speed with enterprise-scale operations remains a core challenge.